Bonanza Offer FLAT 20% off & $20 sign up bonus Order Now

Describe about the Accounting Financial Analysis Report.

This assignment is based on the subject area of accounting. The assignment is divided into two parts. In the first part, the focus has been made on the preparation of adjusted trial balance, comprehensive income statement and statement of financial position for the company Weather and Sons. In the second part of the assignment, the discussion is made on the financial positions of two major airline companies in United Kingdom and that are British Airways and Ryan Air. The analysis and comparison of the annual reports and financial position of the companies are done based on the financial ratio analysis.

| Adjusted Trial Balance | ||||||

| Amount (in £) | Amount (in £) | |||||

| Retained profit | 88000 | |||||

| Sales | 636000 | |||||

| Share capital | 100000 | |||||

| Share premium | 200000 | |||||

| Inventory | 87000 | |||||

| purchases | 230000 | |||||

| trade payables | 86000 | |||||

| trade receivables | 205000 | |||||

| bank | 83900 | |||||

| Motor expenses | 12987 | |||||

| Maintenance | 12000 | |||||

| Salaries and wages | 106000 | |||||

| Administration expenses | 33220 | |||||

| Telephone | 5687 | |||||

| Heat and light | 14300 | |||||

| Equipment at cost | 318000 | |||||

| Provision for depreciation equipment | 45000 | |||||

| Motor vehicles at cost | 45000 | |||||

| provision for motor vehicles | 6000 | |||||

| rent | 68000 | |||||

| advertising | 19118 | |||||

| bad debts | 3788 | |||||

| provision for bad debts | 2000 | |||||

| long term loan | 90000 | |||||

| interest | 9000 | |||||

| equipment depreciation | 47700 | |||||

| motor vehicle depreciation | 11250 | |||||

| prepayments | 13000 | |||||

| accruals | 22600 | |||||

| Suspense | 53000 | |||||

Table 1: Adjusted trial balance

(Source: Created by author)

| Statement of Comprehensive Income of Weather and Sons as on 30th June 2013 | ||||

| Particulars | Amount (£) (Debit) | Amount (£) (credit) | ||

| sales | 636000 | |||

| Closing inventory | 50000 | |||

| Opening inventory | 87000 | |||

| Purchase | 230000 | |||

| Gross profit C/F | 369000 | |||

| Gross profit B/F | 369000 | |||

| Motor expenses | 12987 | |||

| Maintenance | 12000 | |||

| Salaries and wages | 106000 | |||

| Administration expenses | 33220 | |||

| Telephone | 5687 | |||

| Heat and light | 9300 | |||

| Provision for depreciation equipment | 45000 | |||

| Provision for depreciation motor vehicles | 6000 | |||

| Rent | 60000 | |||

| Advertishing | 19118 | |||

| Bad debts | 3788 | |||

| Provision for bad debts | 2000 | |||

| Depreciation on equipment | 47700 | |||

| Depreciation on Motor vehicles | 11250 | |||

| Accrual telephone | 4300 | |||

| Profit before interest and tax | -9350 | |||

| Interest | 9000 | |||

| taxation | 18300 | |||

| Net profit | -36650 | |||

Table 2: Income statement

(Source: Created by author)

| Statement of Financial Position of Weather and Sons for 30th June 2016 | |||||

| Amounts (in £) | Amounts (in £) | ||||

| Fixed Assets: | |||||

| Equipment | 225300 | ||||

| Motor Vehicles | 27750 | ||||

| Total Fixed assets | 253050 | ||||

| Current Assets: | |||||

| Closing inventory | 50000 | ||||

| Trade receivables | 203000 | ||||

| Prepayment of rent | 8000 | ||||

| Prepayment of heat and lighting | 5000 | ||||

| Bank | 83900 | ||||

| Total Current assets | 349900 | ||||

| Total Assets | 602950 | ||||

| Shareholders' fund: | |||||

| Share capital | 100000 | ||||

| Reserve and surplus: | |||||

| Share premium | 200000 | ||||

| Retained profit | 88000 | ||||

| P/L account | -36650 | 351350 | |||

| Current liabilities: | |||||

| Trade payables | 86000 | ||||

| Accrual tax | 18300 | ||||

| Accrual telephone | 4300 | ||||

| Total current liabilities | 108600 | ||||

| Suspense account | 53000 | ||||

| Non-current liabilities: | |||||

| Long term loan | 90000 | ||||

| Total liabilities | 602950 | ||||

Table 3: Statement of Financial Position

(Source: Created by author)

This part of the study has analyzed the financial performance of the two major airline companies in UK and the companies are – British Airways and Ryan Air. The analysis has been done based on the financial ratios. The data has been collected from the annual reports of the companies for 2013, 2014 and 2015. The report has mainly emphasized on three categories of financial ratios – profitability ratios, liquidity ratios and efficiency ratios. The comparison between the financial performance of these two companies are stated below:

Ryan Air and British Airways are the giant companies in airline industry in United Kingdom. Ryan Air has started its business in the year of 1984 and currently, the fleet size of the company is 355 (Ryanair.com 2016).

On the other side, British Airways has started its business in 1974 and it is currently having 295 fleet sizes (Britishairways.com 2016). The financial ratios of the two companies are calculated as per the data available in the annual reports of the companies and stated below:

Financial ratios of Ryan Air:

| Financial Ratios | 2013 | 2014 | 2015 | ||

| Operating profit ratio | 14.7052 | 13.076 | 18.4453 | ||

| Net profit ratio | 11.6564 | 10.3798 | 15.329 | ||

| Current ratio | 3.00361 | 1.51431 | 0.38225 | ||

| Quick ratio | 3.0022 | 1.51321 | 0.38162 | ||

| Receivable collection period | 0.20178 | 0.18117 | 0.13557 | ||

| Inventory turnover period | 3.17187 | 1.80407 | 0.9721 | ||

Table 4: Financial ratios of Ryan Air from 2013 to 2015

(Source: Ryanair.com 2016)

In the above table, it can be identified that the profitability of Ryan Air has increased from 2013 to 2015. In 2013, the operating profit ratio of the company was 14.7052, which increased to 13.076 in 2014 and 18.4453 in 2015. This indicates that the operating profit of the company has increased gradually. At the same time, the above table is also disclosing the fact that the net profit ratio of the company was 11.6564 in the year of 2013, which has declined in 2014 to 10.3798. However, the net profit ratio of the company has increased in 2015 by more or less 5% (Ryanair.com 2016).

As per the table, the liquidity position of the company has declined during the last three years that means from 2013 to 2015. In 2013, the current ratio of the company was 3.00361, which declined to 1.51431 in 2014 and again declined to 0.38225 in 2015. The same type if result can also be identified in the quick ratio of the company. However, the efficiency ratios of the company enhanced during the last three financial years (Ryanair.com 2016).

Financial ratios of British Airways from 2013 to 2015

| Financial ratio | 2013 | 2014 | 2015 | |

| Operating profit ratio | 5.70003 | 8.31982 | 11.1533 | |

| Net profit ratio | 2.46038 | 5.99027 | 22.1301 | |

| Current ratio | 0.63 | 0.65122 | 0.59649 | |

| Quick ratio | 0.60622 | 0.62704 | 0.57211 | |

| Receivable collection period | 3.51545 | 4.14242 | 4.47675 | |

| Inventory turnover period | 29.1364 | 32.4933 | 47.2833 | |

Table 5: Financial ratios of British Airways from 2013 to 2015

(Source: Britishairways.com 2016)

According to the above table, the overall financial position of British Airways was average in the last three years. The profitability of the company has increased in 2015, but the efficiency and liquidity positions of the company have moved to negative directions. The operating profit ratio and the net profit ratios of the company have increased at high rate in the last year but before that, the improvement in the profitability ratios was less (Britishairways.com 2016).

Apart from the profitability ratios, the financial position of the company is also dependent on the other two ratio categories and that are – liquidity ratio and efficiency ratios. The receivable collection period and inventory turnover period of the company are stating that the efficiency of the company has decreased. At the same time, the current ratio and quick ratios of the company are also disclosing the weak liquidity position of the company (Britishairways.com 2016).

According to the above discussion, it can be stated that the financial position and performance of the two companies (Ryan Air and British Airways) were not excellent in the last three years. If the comparison is done between the financial performances of the two companies, then it can be stated that the profitability of British Airways has improved at higher rate than the profitability of Ryan Air. In Ryan Air, the operating profit ratio has been increased by more or less 4% from 2013 to 2015, whereas, in case of British Airways, the percentage increased in the operating profit ratio from 2013 to 2015 was near about 6%.

Along with the operating profit ratio, the percentage increased in the net profit ratio was also high in case of British Airways. In the financial year 2015, the net profit ratio has increased by near about 17% than that of 2014. However, in case of Ryan Air, the percentage increased in the net profit ratio from 2014 to 2015 was much lesser than British Airways. The percentage increased in the net profit ratio of Ryan Air in 2015 was only 5%. These results indicate that the performance of British Airways was better than that of Ryan Air. However, Lukic (2015) mentioned that the sudden increase in the profitability of the company creates doubts in the minds of the investors regarding their company’s business operations.

On the contrary, Dagiliene (2015) noted that improvement in the profitability of the company helps to attract new shareholders and investors. Therefore, if the profitability of British Airways is high then it can attract more investments in the coming financial years. However, the company needs to maintain the high standard of profitability in the future years also. In case of Ryan Air, it can be stated that the company needs to improve its profitability more in order to compete with British Airways as well as the other companies in the Airline industry in UK (Arun, Almahrog and Aribi 2015).

Apart from profitability, the financial health of a company also depends on its liquidity position (Uechi et al. 2015). Due to this, while analyzing the financial position of a company, it is very important to analyze the liquidity position of the organization. If the liquidity positions of British Airways and Ryan Air are compared then it can be identified that liquidity positions have been declined in both the companies. However, the rate of decline is high at Ryan Air than that of British Airways. From 2013 to 2015, the percentage decreased in the current ratio of Ryan Air was near about 3%, where as in the same time span, the percentage decreased in the current ratio of British Airways was 0.4%. It is indicating that the performance level of Ryan Air was low than the performance level of British Airways.

Along with the current ratio, the quick ratios of the companies are disclosing more or less the same result during the last three years. Percentage decreased in the quick ratio of Ryan Air was near about 3%, whereas the percentage decreased in the quick ratio of British Airways was 0.3%. Therefore, it can be understood that in the last year, the performance of British Airways was better than Ryan Air in terms of liquidity, but the performance of the two companies was not of high standard. However, in 2013 and 2014, the liquidity position of Ryan Air was better than the British Airways. This indicates that Ryan Air has the capacity of quality or liquidity improvement, which the company can utilize in the coming years, if it want to sustain in the market (Garefalakis et al. 2016).

Apart from the liquidity and profitability, analyzing the level of efficiency is also very important to understand the actual financial position of the company. The level of efficiency of a company can be understood with the help of the efficiency ratios of the company (Sulkava et al. 2015). In case of the Ryan Air and British Airways, the performance of Ryan Air was better than British Airways in respect to the receivable collection period. The receivable collection period of a company indicates the efficiency of the company in converting its receivables or debts into cash. If the receivable collection period of a company is less then it denotes that the company is efficient in converting the receivables into cash (Rajitha and Babu 2015).

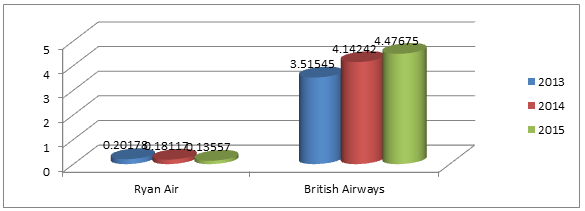

Figure 1: Receivables Collection Period of Ryan Air and British Airways

(Source: Created by author)

In case of Ryan Air, the receivable collection period has decreased gradually from 2013 to 2015. In 2013, the receivable collection period was 0.20178, which decreased to 0.13557 in 2015. On the other side, in case of British Airways, the receivables collection period has increased from 2013 to 2015. In 2013, the receivable collection period was 3.51545, which increased to 4.47675 in 2015. Therefore, it is very clear that Ryan Air was more efficient than that of British Airways. At the same time, it can also be said that British Airways needs to take care of the receivable collection period, so that it does not increase further.

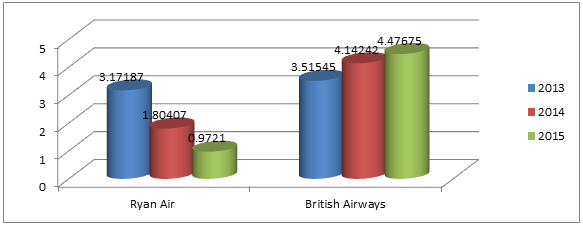

On the other hand, if the efficiency level is measured with the help of inventory collection period, then it can also be identified that the performance of Ryan Air was better than British Airways.

Figure 2: Inventory Turnover Period of Ryan Air and British Airways

(Source: Created by author)

The inventory turnover period of Ryan Air has decreased from 2013 to 2015 but in the same time span, the inventory turnover period of British Airways has increased. This indicates that the inventory management system at British Airways was weak than that of Ryan Air during the period of 2013 to 2015.

Therefore, from the overall discussion, it can be said that the financial performance of Ryan Air was better in the years of 2013 and 2014. However, in 2015, the performance of British Airways was better than the performance of Ryan Air. However, the efficiency level was always good at Ryan Air.

Conclusion

In this assignment, the comprehensive income statement of Weather and Sons has been prepared and it has been identified that the company has incurred loss in the financial year. On the other side, in the second part of the assignment, it has been identified that the liquidity position and the efficiency level of Ryan Air are better than that of British Airways. However, in case of profitability, the performance of British Airways was better in last three years.

Reference list and Bibliography:

Arun, T.G., Almahrog, Y.E. and Aribi, Z.A., 2015. Female directors and earnings management: Evidence from UK companies. International Review of Financial Analysis, 39, pp.137-146.

Bell, C., 2015. Generic organizational strategy integration impacts on profit margin ratio and inventory turnover in publically traded Oklahoma manufacturing organizations (Doctoral dissertation, INDIANA STATE UNIVERSITY).

Bowman, D., Cai, F., Davies, S. and Kamin, S., 2015. Quantitative easing and bank lending: Evidence from Japan. Journal of International Money and Finance, 57, pp.15-30.

Britishairways.com. 2016. Book Flights, Holidays & Check In Online | British Airways. [online] Available at: http://www.britishairways.com/ [Accessed 7 Aug. 2016].

Dagiliene, L., 2015. THE INVESTIGATION OF FINANCIAL REPORTS’COMPLEXITY IN LARGE COMPANIES. Economics and Management, (14), pp.28-32.

Garefalakis, A., Mantalis, G., Lemonakis, C. and Vassakis, K., 2016. Determinants of Profitability in Aviation Industry of Europe and America.International Journal of Supply Chain Management, 5(2), pp.131-137.

Hancerliogullari, G., Sen, A. and Agca, E., 2016. Demand uncertainty and inventory turnover performance: an empirical analysis of the US retail industry. International Journal of Physical Distribution & Logistics Management, 46(6/7).

Joshi, A. and VYAS, D.V., 2015. A study of liquidity ratios of selected private sector banks of India. ZENITH International Journal of Business Economics & Management Research, 5(5), pp.131-137.

Khan, M.N. and Khokhar, I., 2015. THE EFFECT OF SELECTED FINANCIAL RATIOS ON PROFITABILITY: AN EMPIRICAL ANALYSIS OF LISTED FIRMS OF CEMENT SECTOR IN SAUDI ARABIA. Quarterly Journal of Econometrics Research, 1(1), pp.1-12.

Lukic, R., 2015. The Analysis of Efficiency of Managing Inventories in Trade in Serbia. Revista de Management Comparat International, 16(2), p.222.

Prommin, P., Jumreornvong, S., Jiraporn, P. and Tong, S., 2016. Liquidity, ownership concentration, corporate governance, and firm value: Evidence from Thailand. Global Finance Journal.

Rajitha, P. and Babu, P.C., 2015. A Study on Liquidity and Profitability Position with Reference to ITL Pvt. Ltd. The International Journal of Business & Management, 3(8), p.98.

Ryanair.com. 2016. Official Ryanair website | Cheap flights | Exclusive deals. [online] Available at: http://www.ryanair.com [Accessed 7 Aug. 2016].

Sulkava, M., Sepponen, A.M., Yli-Heikkilä, M. and Latukka, A., 2015. Clustering of the self-organizing map reveals profiles of farm profitability and upscaling weights. Neurocomputing, 147, pp.197-206.

Uechi, L., Akutsu, T., Stanley, H.E., Marcus, A.J. and Kenett, D.Y., 2015. Sector dominance ratio analysis of financial markets. Physica A: Statistical Mechanics and its Applications, 421, pp.488-509.

Upload your Assignment and improve Your Grade

Boost Grades