Bonanza Offer FLAT 20% off & $20 sign up bonus Order Now

Security threat is on one the major threats that a company has to encounter. The invasion of unauthorized entry in the data system of a company results in major loss and issues for the company. It hinders the business operation and consequently casts a detrimental effect on the financial conditions of the company. The following report is made on Nintendo. The incident relates to the leakage of confidential data of Nintendo on the internet. This caused panic and raised an alarm to the company regarding the security aspect of the company. Stealing and unethical handling of the information can cause serious damage to a company. The report intends on studying the consequences and the effect of security lapses in a company.

Company BackgroundNintendo is a Japanese multinational company, located in Minato, Tokyo. The company was founded on 7 May 1946 in Tokyo, Japan. The founders of the company are Masaru Ibuka and Akio Morita (capcom. 2016). The company is a corporate organization that indulges in producing electronics and entertainment. Nintendo Corporations primarily deals in electronics. The number of employees for the company is 125,300 and the current revenue of the company 8.105 trillion in the previous financial year (2015-16) (Nintendo 2016). The company thrives in products like customer electronics, videogames, media and entertainment, computer hardware etc.

Key IssuesSecurity of a company is very important since a lot of stakeholders are involved with a company. The key issue related to Sony Company were regarding to the hacking incidents that occurred in the company and the leakage of 100 terabytes of information. This caused disruption in the business operations of the company and had serious implications on the financial conditions of the company (Nintendo.com 2016).

The rationale for choosing Sony as the company is because Sony is a multinational company and one of the most reputed companies in the world. The security threats associated with the company was very critical and important since it leaked major and confidential information of the company and it caused severe consequences on the operations and financial conditions of the company.

Security ThreatWhat would convert into the security nightmare in the modern history started as a joke between screenwriter Evan Goldberg and actor Seth Rogen of producing a comedy about the assassination of the North Korean leader Kim Jong –un. The joke became a reality on March 2013 where the announcement was made by Sony Pictures Entertainment that the screenwriter and actor are making the movie indeed and it is titled ‘The Interview’. The movie was scheduled to hit theatres by the end of 2014 originally; however before the scheduled release of the movie an event happened that empowered the hackers to take control of the company’s network completely (Sanchez, G. 2015). Sony pictures entertainment was compelled to take the network offline as the hackers released a portion of the 100 terabytes data controlled by them in the internet. The company’s security numbers, salaries, movies and identifiable personal data were flooding the internet. This incident related with the security issue made the company rethink the security aspects of the company.

Current statusThe CEO responded to the unfortunate event and uncertainty resulting from this cyber attack and the awkward situation faced by the company in which he quoted that for an incident like this there is no playbook and it increased the difficulty for the company to recover (Sanchez, G. 2015). In the earnings report it was stated that the company would incur $15 million to conduct the investigation and remediation related with the hack related with quarter 31st December, it was also made clear by the senior GM Kazuhiko Takeda that financial loss for the fiscal year 31st march would amount to $35 million In addition head of Sony pictures entertainment Amy Pascal resigned as the result of the hacking scandal.

Goal of this assignmentThis project is executed to examine the financial implication of this hacking incident on Sony and its business. It will evaluate the market impact on the current business unit based on this event. A financial benchmarking with competitor like Nintendo and Capcom would be done with porter’s five forces analysis to gain competitive edge in the market. It will also conduct the analysis of external environment with PESTLE model to identify potential areas of development (Birkinshaw, 2004). The major finding of the benchmarking process and business environment will examined in a scenario analysis of selected financial figures of Sony Based on business analysis the report will conclude with recommendation.

Nintendo multinational company established in 1946 by two people Masaru Ibuka and Akio Morita with head office in Tokyo, Japan and it ranks 116th in the Fortune Global 500 companies on the 105 list. The product portfolio of the company comprise of consumer and professional electronics, gaming products. (nintedo.com 2016). The company registered a revenue generation of 8.105 trillion yen with a net income of 147.8 billion in the current quarter of 2016. The company has strong human resource supported by 125,000 employees across the global

Business unitsNintendo has grouped the business of the company into four business verticals and they are electronics, music and games, entertainment, and financial business. In April Nintendo Ssegmented the business unit mobile communication (MC), Imaging products & solutions (IP&S). Game & Network services (G&NS) and Home entertainment & sound (HE&S). The network was part of G&NS and medical businesses were part of IP&S (Nintendo.com2007).

Revenue Analysis and forecasting

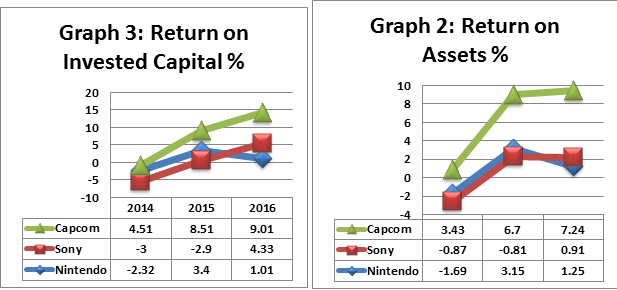

The revenue ratio for Nintendo in 2014 was -1.69 in 2014, which increased to 3.15 in 2015 to 1.25 in 2016. There was a sharp increase in the revenue of the company in 2015 to its earning in 2014. This was due to an increase in sales and reduced operation cost. However, it dipped to 1.25 in 2016, signifying a drop in the sales of the customer and non-judicious use of the resources. The revenue ratio for Sony was -0.87 in 2014, -0.81 in 2015 and 0.97 in 2016. The revue of Sony slowly and gradually increased, depicting a steady growth in the sales of the company. Capcom was 3.43 in 2014, 6.7 in 2015 and 7.24 in 2016. This indicated a major growth in the revenue of the company and consequently depicted a strong growth in the sales and profitability index of the company (financials.morningstar 2016).

Market Growth

The average growth rate of Nintendo is 8.72 and it has slowly and steadily developed a strong hold over the market and enjoys a competitive advantage in comparison to the rival firms. The current market growth rate for Sony is 0.04. This comparison shows that Nintendo has a clear cut advantage in comparison to both the companies and has a strong market share and market growth rate (financials.morningstar 2016).

Profit margin

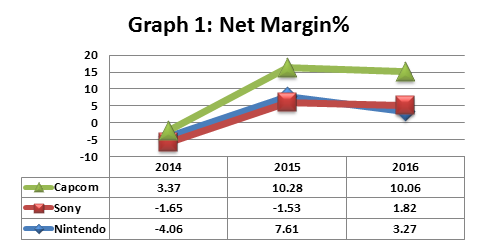

The net margin of Nintendo for the year 2014 was -4.16%. This depicted a loss for the company since the operating expense of the company was more than the revenue. However, in 2105, the figure rose to 7.61%. This depicted a substantial increase in the sales and subsequent reduction in the cost of the company. There was an increase in the number of the customers of the company, which was followed by increase in the profitability index as well. The year 2016 depicted a Net margin of 3.37 %. This resulted in the reduction of sales in addition to the reduction of profit of the company. The year depicted an increase in the expenditure value of the company (financials.morningstar 2016).

Competitors like Sony had a net margin of -1.65 in 2014, -1.53 in 2015 and 1.82 in 2016. This highlighted a steady upward growth in the revenue and profitability index of the company. The company suffered a loss in 2104 and 2015, which was followed by a profit of 1.82 % in 2016. This depicted a major increase in the net margin and revenue of the company.

Capcom on the other hand had an increase of 3.37 % net margin in 2014, followed by 10.28% in 2015 and 10.08% in 2016. This highlighted a strong revenue and profitability index for the company and it depicted a string customer base and turnover ratio for the company. However, there was slight dip in the revenue of the company in 2016 as it dipped from 10.28 to 10.08 % (capcom.com 2016)

Since the organization is engaged in the design, development, sale and manufacture of electronic devices and equipments as well as software and consoles it compete with several organizations not only with their home market but with global market also. The organization market segmentation will analyzed with the help of evaluation of share trends of past few years as well as its market positions (sony, 2016).

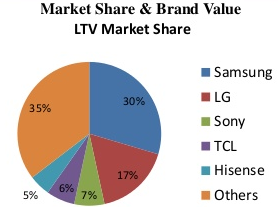

As per the above represented figure it has been gained that Nintendo covers 7% LTV market share whereas its competitors like Samsung covers 30%, LG covers 17%, others covers 35% and remaining hisense, TCL covers 5% and 6% respectively. Thereby as per the available data, it has been seen that there are three big players in market covers approximately more than 80% that represents stiff competition.

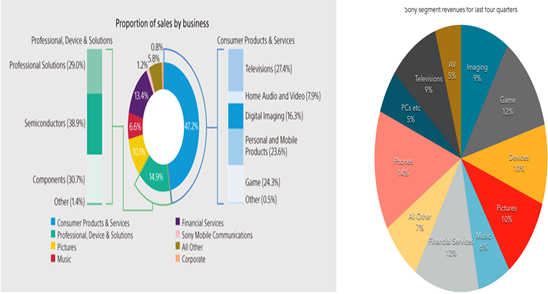

As per the above represented figure it has been seen that the organization propositions of sales by business includes Televisions who covers approximately 27.4%, home audio and video who covers approximately 7.9%, digital imaging covers 16.3%, personal and mobile products covers 23.6%, game covers 24.3% and remaining 0.5% others. Thereby this figure indicates that the company manufactures almost all electronic products to gain better market brand and share. Second graph indicates that the organization Nintendo make more revenue through Gaming, picture, television and financial services. Thereby this figure shows that to enhance profit in effective manner company needs to require invest more money in these areas and in addition to this company requires to use opportunities and R&D in those area from where company earn less profits.

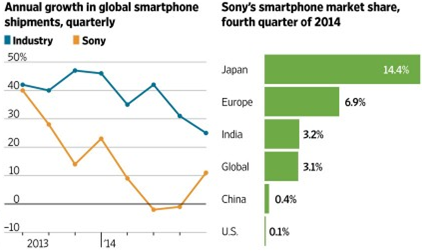

The above figure represents that the company market share in FY 2014 is 14.4% in its home market i.e. in Japan, whereas in Europe its share market is 6.9%, in India it share market 3.2%, in Global its share market 3.1% and remaining China and US its share market is 0.4% and 0.1%. In addition, this figure represents that sales have fallen very fast as compare to the organization average (Nintendo.com 2016). In addition to this, it has been seen that in china and US the company performance is below than its competitors such as Samsung and Apple in terms of electronic appliance. Thus, this figure shows that the company has effective opportunities to enhance its market share.

This section evaluates selected KPI’s of the company Sony to determine possible areas of critical potential improvements and developments. The KPIs of Nintendo will be standard with its competitor’s performance. The company that has been selected to their relevance in challenging Sony’s business unit and availability of its financial data.

| Company name | Description |

| Nintendo | It is Japanese multinational software organizaiaton and electronic based company and manufactures video game companies (nintendo, 2016). |

| Capcom | It is also Japanese based organization and is quarters are Japan, California, and Osaka etc. The company manufactures video games as well as entertainment (capcom, 2016). |

In order to compare the company financial performance as well as performance within the market financial analysis ratios and key performance indictors has been selected.

| Ratios | KPIs |

| Profitability ratios | Organization revenue growth |

| Liquidity ratios | Solvency |

| Efficiently ratios | Innovation |

One of the limitations for Nintendo was that the company’s performance and operations were seriously hampered. The net margins of the company reduced in the financial year 2014-15. It depicted inefficiency and lack of effective operations of the company. The profitability of the company was hampered.

Company’s net profit decreased in the current financial year, which depicted that the profitability and the revenue of the company reduced, which reduced the brand value of the company (nintendo.com2016).

Nintendo lost its competitive advantage with a fall in the sales of smart phones and the rise of competitors like Samsung and Apple. This also resulted in fall of the operations and profitability. It also resulted in the loss of market share of the company. (nintendo.com).

| PROFITABILITY |

| 2014 | 2015 | 2016 |

| Net Margin % | Nintendo | -4.06 | 7.61 | 3.27 |

| Sony | -1.65 | -1.53 | 1.82 | |

| Capcom | 3.37 | 10.28 | 10.06 | |

| Return on Assets % | Nintendo | -1.69 | 3.15 | 1.25 |

| Sony | -0.87 | -0.81 | 0.91 | |

| Capcom | 3.43 | 6.7 | 7.24 | |

|

|

| 2014 | 2015 | 2016 |

| Return on Invested Capital % | Nintendo | -2.32 | 3.4 | 1.01 |

| Sony | -3 | -2.9 | 4.33 | |

| Capcom | 4.51 | 8.51 | 9.01 |

As per the above-represented figure, it has been gained that company Nintendo net margin at the end of FY 2014 and 2015 represents negative values that represents that shows that company performance was not much effective during these years. In addition, the company performance is increased in FY 2016 with positive values of 1.82 net margins that indicate company using effective strategies and Cost cutting strategies the company functioning well. On the other hand as per the industries average rate, it has been gained that company net profit margin was not much effective and this represents that company brand values decreased (Palepu, Healy and Bernard, 2000).

As per the return on assets the company Nintendo ranks in last position and the company capcom gain approximately seven times higher than Sony gain approximately 1.5 time higher than Sony in FY 2016. On the other hand, returns on invested capital the company sonny gain negative values in FY 2014 and FY 2015 respectively and this may be happened because in year of 2013 the company would incur $15 million to conduct the investigation and remediation related with the hack related with quarter 31 December. Furthermore, return on invested capital is two times higher than Sony that represents that has lacks a sufficient based of generating returns and products.

| LIQUIDITY |

| 2014 | 2015 | 2016 |

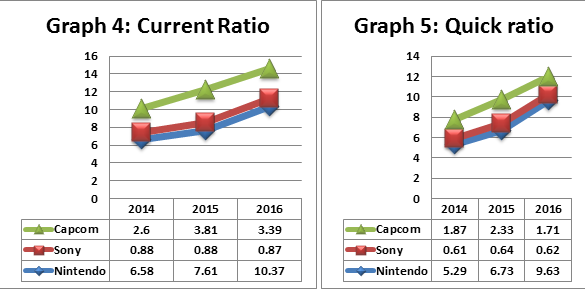

| Current Ratio | Nintendo | 6.58 | 7.61 | 10.37 |

| Sony | 0.88 | 0.88 | 0.87 | |

| Capcom | 2.6 | 3.81 | 3.39 | |

|

|

| 2014 | 2015 | 2016 |

| Quick ratio | Nintendo | 5.29 | 6.73 | 9.63 |

| Sony | 0.61 | 0.64 | 0.62 | |

| Capcom | 1.87 | 2.33 | 1.71 |

As per the Liquid ratios it has been seen that company Nintendo current ratios decreasing continuously as well as current ratios also decreasing. On the other hand, its competitors Nintedo current ratios is 10.37 in FY 2016 i.e. approximately 9 time higher than Sony. On the other, hand Nintendo Quick ratios also represents negative manner from FY 2014 to FY2016 and this indicates that company Sony suffered from liquidity problems (Palepu, Healy and Bernard, 2000).

| EFFICIENCY |

| 2014 | 2015 | 2016 |

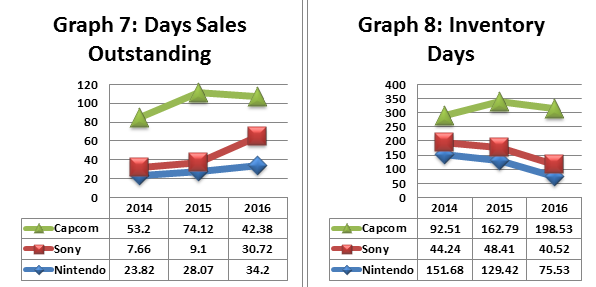

| Days Sales Outstanding | Nintendo | 23.82 | 28.07 | 34.2 |

| Sony | 7.66 | 9.1 | 30.72 | |

| Capcom | 53.2 | 74.12 | 42.38 | |

|

|

| 2014 | 2015 | 2016 |

| Inventory Days | Nintendo | 151.68 | 129.42 | 75.53 |

| Sony | 44.24 | 48.41 | 40.52 | |

| Capcom | 92.51 | 162.79 | 198.53 | |

|

|

| 2014 | 2015 | 2016 |

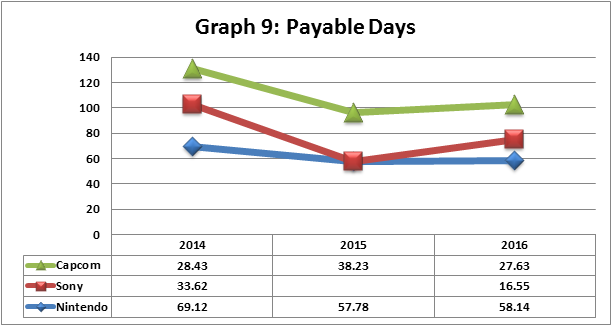

| Payable Days | Nintendo | 69.12 | 57.78 | 58.14 |

| Sony | 33.62 |

| 16.55 | |

| Capcom | 28.43 | 38.23 | 27.63 |

As per the above analysis and interpretation it has been observed that the company Capcom is ahead of remaining others organization in terms of inventory day, days sales outstanding. Capcon inventory days is approximately four and half times higher than the Sony whereas payable days one and halftime higher than Sony. This is most likely by triggering the less performance of smart phones and Pcs with higher cost and lower revenue to simulate sales.

This part of project evaluate the present business environment of Sony with respect to the global perspective focussing on the Home entertainment & sound (HE&S) business vertical as it contributes to the major part of the revenue (Birkinshaw, 2004). The results of a converged PESTLE analysis and Porter’s five forces analysis will assist in the scenario based forecast of the financial performance of Sony for the next three consecutive years (2014 -2016) conducted in the next chapter.

With the help of the two analytical model mentioned above the business environment of Sony is analyzed both at micro (Porter) and at macro (PESTLE) level.

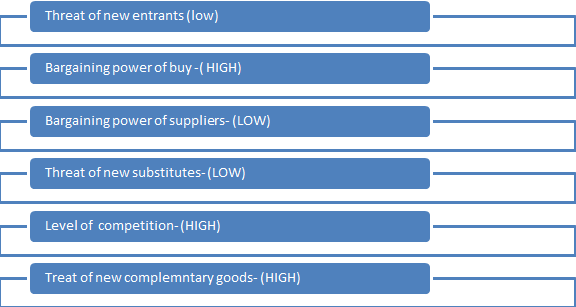

According to Porter the industry competition is guided by the five forces namely threat of new entrants and substitutes, rivalry from existing players and bargaining power of supplier and customers (Jeffs, 2008). Though this is applied by most companies to understand the industry competition there was wide criticism. The major criticism is summarized below

Thus the combination of Porters six force with PESTEL framework provides better overview of the industry scenario (Jeffs, 2008).. Further a multinational company like Nintendo needs to conduct this combined analysis to different market separately or to each regional business association like NAFTA, EU and AFTA.

Porter’s six forces of Nintendo

Threat of new entrants

The threat of new entrant is low. The start up capital for an electronic industry is high. Therefore the threat of new entrant is low.

Bargaining power of buyer

The bargaining power of buyer is very high. The customers do not have a lot of option regarding the selection of buyers and therefore, the bargaining power of Sony is high because of brand value (Jeffs, C. (2008).

Bargaining power of supplier

The bargaining power of supplier is low. Nintendo has a rich pool of suppliers and no specific preference is given to any supplier. As such the bargaining power of the supplier is low.

Threat of new substitutes

The threat of new substitutes is low for the company. Nintendo has good brand value and customer loyalty. The product portfolio of Nintendo is vast and such there is low threat of new substitutes.

Threat from Rivals

There is intense competition in the electronic industry and as such there is presence of good and reputed rivals in the industry. Thus, there is major threat from rivals (Jeffs, C. (2008).

Threat from Complimentary Product

The threat of complimentary product is low for Nintendo because of the brand image and brand value.

(financials.morningstar 2016).

| Factors | Description |

| Political | Instable government will have impact on the company. |

| Economic | Recessions and changes in the interest rates and monetary policy of the company will have major impact on the company. |

| Social | Changing lifestyle and communication will have impact on the company (Jeffs, C. (2008). |

| Technological | Good infrastructure and technology driven company. Good technological state in the country. |

| Environmental | Environmental conservation and sustainability practices affect the business of the company. Pollution control and health issues. |

| Legal | Change in the labor law and international trade law affect the business of the company. |

(Nintendo.com 2016).

Political factors

The political structure of Japan is highly instable and volatile. As a result, the rules and regulations of the government might affect the policies and strategies of the company.

Economic factors

Economic factors also play a major role in this regard. The recession in Japan will affect the business operations of Nintendo . The increase in the interest rate and borrowing capacity of the workers will have a deep impact on the company.

Social factors

The lifestyle and communication pattern has a major role on the business operations of the company. Gender stereotyping and changing lifestyle of people will have an impact in the operations and profitability of the company.

Technological factors

Nintendo is heavily dependent on technology. The company has to embark on upgraded and innovative technology to meet the requirements of the company and in the process gain competitive advantage and implement innovative strategy.

Environmental factors

Nintendo is a reputed Multinational company and therefore outs deep implication on ethical practice. The growth of ethical consumerism makes it critical and important for the company for follow ethical practice and practice sustainability and environmental conservation.

Legal factors

Legal factors have an important role in the operations and profitability of Nintendo. Changes in Labor law and international trade, rules and regulations of the company will critically affect the business operations (Nintendo.com 2016).

Based upon the financial performance analysis of the company Nintendo, scenario analysis has been developed. Here two most effective scenarios are explained and their influences on cost, margin, revenue as well as income have been computed. The worst-case scenario objectives to analyze the areas that should be monitored;

| Revenue | Most likely | Worst likely |

| Global economy | Effectively recover, continues demands to grow

| Worldwide growth rate has been deceased Total sales has been declined by approximately 2% per year |

| Cost and margins | Operating income at the end of FY 2016 the company Sony archived approximately 294197 that indicate company performance increased as compare to previous years. | Company profitability ratios as well as liquidity ratios are in under pressure (nintendo, 2016). Operating margin of Nintendo 2013:34% 2014:23.3% 2015:25.1% 2016:24.7 % |

Outcomes: As per the analysis it has been seen that company revenue as well as profitability have been reduced in last few years. On the other hand, it has been seen that company sales performance in terms of PCs as well as smart phones have been reduced that lead the company performance in negative manner and reduce the customer’s confidence. On the other hand worst case scenario explains that company Nintendo faced financial problems as well as operating income declined. (Birkinshaw, 2004).

Thereby as per this scenario, I recommended that to improve the performance company requires to implement an effective cost cutting strategies as well as implements effective management strategies that would helps them to improve the performance of the company in terms of sales and revenue.

It can be concluded that the company has a scope to increase its production level due to its high current ratio. The working capital of Nintendo is high and therefore, the company can increase its production and thereby increase its profitability level. Due to its stable price per earning and revenue growth, the company can embark on improving the technology innovation, which will improve gaming experience of users and strengthen the customer base of the company. The company has good and updated technological level. The company can utilize it strong market share and stress on increasing and expanding the demographic of the gaming customers. Due to its stable and good net margin, the company should utilize the opportunity of investing in research and development that will help the company in diversifying and expanding its business. Due to low threats of entrants and innovation strategy adopted by Nintendo, the company can adopt the strategy of expansion of digital business.

Based on the SAFe model, certain recommendations can be made. As per the scenario forecast, the return on asset would 0.91 to 0.03 in 2019 and in worse case it would be dip to 0.01. In such a case, the company can attempt to make judicious use of resources to increase its production. More investment in upgrading technology and incorporating innovation would help to increase the profitability and customer base and it would increase its return on assets.

As per the model, Nintendo would drop its net margin from 1.82 in 2016 to 0.05 in 2019 and 0.01 in worst cases. The company can invest in research and development to improve its performances and induce economies of scale with improve production process.

capcom. (2016). capcom. [online] Available at: http://www.capcom.com [Accessed 3 Aug. 2016].

financials.morningstar. (2016). financials.morningstar. [online] Available at: http://financials.morningstar.com/ratios/r.html?t=SNE [Accessed 3 Aug. 2016].

Fridson, M. and Alvarez, F. (2002). Financial statement analysis. New York: John Wiley & Sons.

nintendo. (2016). nintendo. [online] Available at: http://www.nintendo.com [Accessed 3 Aug. 2016].

Palepu, K., Healy, P. and Bernard, V. (2000). Business analysis & valuation. Cincinnati, Ohio: South-Western College Pub.

sony. (2016). sony. [online] Available at: http://www.sony.com/ [Accessed 3 Aug. 2016].

Birkinshaw, J. (2004). Strategic management. Cheltenham, UK: Edward Elgar Pub.

Jeffs, C. (2008). Strategic management. Los Angeles: SAGE.

Case Study: Critical Controls that Sony Should Have Implemented. SANS Institute InfoSec Reading Room. [online] Available at: https://www.sans.org/reading-room/whitepapers/casestudies/case-study-critical-controls-sony-implemented-36022 [Accessed 3 Aug. 2016].

Sony.co.uk. (2007). Sony UK | Latest Technology & News | Electronics | Entertainment | Sony UK. [online] Available at: http://www.sony.co.uk/ [Accessed 3 Aug. 2016].

Upload your Assignment and improve Your Grade

Boost Grades