Bonanza Offer FLAT 20% off & $20 sign up bonus Order Now

Question:

Write a report about the "communication is important medium in organization".

Communication is the effective tool which is used as the important medium in organization. Effective communication is necessary to initiate in the organization. It enables the organization to perform the basic functions of the management. Communication need to involve in the way so that it plan, organize and control it. The advertisement on television initiates emotion and enable the target audience to make attachment because of the message. The viewers could relate the product or the service with it. Television advertisement enables to give instant credibility for their service and the products offered[1].

Banking sectors of the largest global financial access network. The services provided by the banking sectors can be classified into various spectrums. The commercial bank provides services where money could be kept in safe and allows the withdrawals when necessary. Investment banking services allows for the services in the capital market service, private banking and brokerage service. The insurance sectors consist of services in insurance brokerage, Finance and Insurance service, insurance underwriting and Finance and Insurance[2].

The operations of the banking sector include the regular transactions which provide loans, mortgages and investments. The banking sector includes the customer loans, mortgages and offer products. The operations also include the accessibility of the branches and the ATMs[3].

The operations of the banking and the insurance sectors include providing stability in maintaining the internal and the external value of currency. They develop the aim for fostering the economic development for the country. The operations, which included in the sectors are the monetary management, foreign exchange management, financial inspection, payment and settlement system, currency issue, financial agency function, participation in the international activities and the statistics and research[4].

The banking and the insurance sector his one the most developed, sophisticated and highly competitive sector. It includes a strong competition on the world’s market. The sector has the maximum growth and its needs to operate efficiently[5].

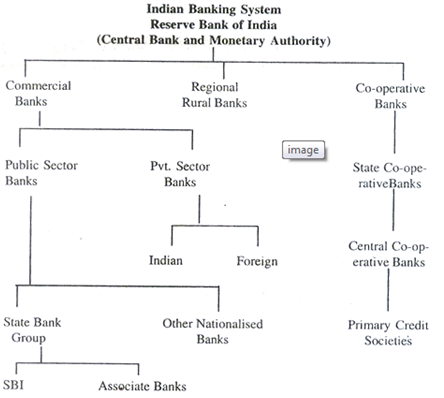

The banking sectors are guarded by the central bank. Classification of banks comes according to its operations. Commercial banks, institutional banks and other financial institutions are the further classification of the banks. The central bank safeguards these banks[6].

Figure 1 showing structure of Indian Banking System

Source [7]

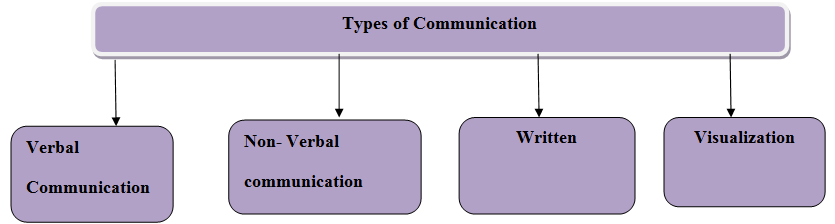

Communication is the process through which the information is transferred from one place to another. The sender encodes the message and the receiver decodes it. The sender selects the channel of communication through which they need to send the message. The channel through which the sender sends the message can be verbal, non-verbal, written or through visualization in the forms of graphs and charts. The communication can be transmitted in an organization through various channels like face-to face conversations, telephone calls, text messages, Television etc[8].

Figure2 showing Types of Communication

Source[9]

The banking and the insurance sectors similarly uses many communication channels to make the communication more effective. However in this study we analyzed the two communication source one from the television advertisement and another from the telephone calls. Both the communication categorizes in verbal communication. The television communication can be classified as classic communication. The communication telephone calls are the most common means to materialize the internal as well as the external communication. It is one of the most important medium as it enables to create the first contact with the company is made. The communication can operate through various devices like fixed individual devices, private branch exchanges and the mobile devices[10].

The communication through television imports an impression on the receiver minds through its audio and visual effects. A television advertisement on National Australia Bank under

the production house of The Sweet Shop made an advertisement which created a positive effect on the minds of the views of the advertisement. The Clemenger BBDO Melbourne and the National Australia Bank launched a new campaign in home loans. The advertisement showed the ‘Journey’, which aims set, the campaign of NAB. It initiates to understand the home ownership journey, which included the big moments of the truth, or the leaps that the customer initiates[11].

Figure3 showing the journey advertisement of NAB

Source[12]

Telephone calls from the banking and the insurance sector has become the most popular communication. However, the communications revolves around risk of involvement of fraud as the receiver cannot see the sender of the message. The Independent Banking Advisory Service has explained one such example. They warned customers to take prevention on the Bank calling about the overcharges scam. The man who used to call already had some details of the account holders. The man used to claim that the account holder has been overcharged for the account. The further ask the customers to give him the details about the account. The Independent Banking Advisory Service warned the customers not to give the personal information over phone as it elaborate the scam which is uncovered[13].

The advertisement on television is of the most major and important communication of the banking and the insurance companies. It enables t give customers with certain information about the services and meets the need of the target audience[14].

The audience gets influenced for the using of the services through the television advertisement. The telephone calls are the one-to-one conversation where the senders are unable to see receiver and vice versa[15]. Though, the customers get information through phone but it generally lacks the influencing power. The customers unable to trust the executives and so do not get convinced over phone.

Advertising enables to create the brand for the specific audience. People get aware about the brand as it creates an impression. The consumer feels connected with the advertisement on the television and influence in the purchasing behavior. It initiates to build a loyalty towards the brand if the advertisement comes repeatedly on the television[16]. However, the approach of the representatives through telephone does not able to create the brand value for the organization. They became aware about the brand through phone but, it does not influence much for the purchasing power of the customers.

The content of the advertisement is authentic and people trust the advertisement. While, the telephone calls always has the tendency of scam or fraud. It enables the customers not to trust the brand quickly. The attempt of both the communication has the same aim to create consciousness of the brand among the customers. However the approach is different has customers takes the advertisement more positive way as it does not involves any risk of fraud or scam[17].

Television acts as an important medium to display a message. The advertising is the best way to convey the message for the brand. The advertising gathers a wide audience for their service. It initiates towards the viewers when they are most attentive in watching the television shows. Further, it allows conveying the message with the audio, visual ad motion. It enables the banking and the insurance sectors to make creativity and attach a personality of their business. Banking and insurance is a sector which mostly consists of repeat customers. The creativity and the personality enable them to continue with the service that they offer[18].

Telephone communication is one of the important modes for the verbal communication. The use of communication through telephone calls could initiate the scam or fraud incidents. The fraud or the scam individuals or teams often call to take the details about the account of the customers[19]. The customers sometimes feels irritated because of the repeated call from the banking or insurance company. Conversation on telephone does not create the provision of face to face conversation which, in return could influence the clients in effective way. The telephone call creates a barrier communication as it initiates the network problem. Network problem enables the clients not to hear the voice clearly. The customer gets irritated because of it. The communication sometimes creates communication gap between the sender and the receiver of the message.

Banking and insurance sector is the industry, which mostly consists of clear communication between the representatives and the customers. Customers need to understand the policies that need to undertake. The industry aims to greater long term relationship with the customers through effective communication. Telephone communication is the major communication in the industry. However, direct supervision is not possible over phone. On the other hand the policies need have clear understandings from the customer’s part. While, family or work distraction unable to concentrate on the communication over phone. Again the source creates security problems. Clients trust the bank and store valuable items there including cash and other asset. Now, such security problems create over phone creates a wall between the communications over phone[20].

Television advertising acts as an important medium in the mind of the customers. The people get to know about the addition of new policies. The majority of the commercials in the banking and the insurance sectors are featured with a jingle or a song[21]. Virtual advertisements are generally included between the television programming through the computer graphics. It makes the customers to attract on the products and the services.

Conclusion

Banking sectors of the major worldwide financial admission system in world. The communication can be conveyed in an association through diverse channels. Direct supervision is not possible over phone. Communication through the television communication ensures the most powerful marketing contacts. Television advertising acts as an important medium in the mind of the customers. The people get to know about the addition of new policies.

Reference list:

Upload your Assignment and improve Your Grade

Boost Grades