Bonanza Offer FLAT 20% off & $20 sign up bonus Order Now

Capital procurements avenues have increased exponentially with the advent of bond markets. The flow of credits both for longer terms and medium time periods are addressed through issuances of bonds and promissory notes. The Australian bond market deals with different sets of financial instruments comprising of mortgaged backed securities, over the counter bonds, and outstanding stocks. The repercussions of global financial crisis resulted towards the emergence of corporate bonds markets in Australia because of the credit crunch experienced by most firms (Black et al. 2016). Moreover, the facilitation of credit towards long term programs was required due to imminent capital restructuring programs. Alcock, Finn & Tan (2012) states that the risks pertaining to credit default swaps and financial derivatives results in freezing of financial assets. The transfer of tailed risks by the banking and financial organizations on to other sectors of the economy led to a domino effect of unfavorable financial circumstances that pervaded the entire Australian economy at a rapid pace. Moreover, as the product line in terms of bonds and other financial instruments increased the investors were provided with numerous alternatives to invest their capital. Inchauspe, Ripple & Trück, (2015) mentions that the bonds market has a self regulatory framework in the sense that the companies past activities along with revenue generating abilities are evaluated by the bond holders prior to purchasing bonds.

The government bond markets have existed for a very long time as those bonds were riskless as the probability of defaults was marginal. Exponential increase in the corporate activities along with the rise in overall risks levels led to unfavorable lending rates by banks and financial institutions. Moreover, as Australian government required lesser quantum of borrowings owing to negligible budget deficit the market for corporate bonds experienced a growth. Corporate institutions improvised upon market opportunities to issue bonds directly to its investors in order to cope up with the unfavorable lending rates of banks (Gyntelberg & Upper, 2013). The fall in issuance of both Australian and state government bonds coupled with the rising levels of capital deficits in the corporate sector resulted in rapid growth of the indigenous bond market. As mentioned by Gozzi, J. C., Levine, R., & Schmukler, S. L. (2012), the debt crisis in terms of the European Nations, particularly the Greece sovereign debt crisis led to temporary halt in bond market activities. Moreover, the repercussions of New York Federal Reserve taper continued to affect the level of transactions leading to lesser issuance of bonds by corporate borrowers.

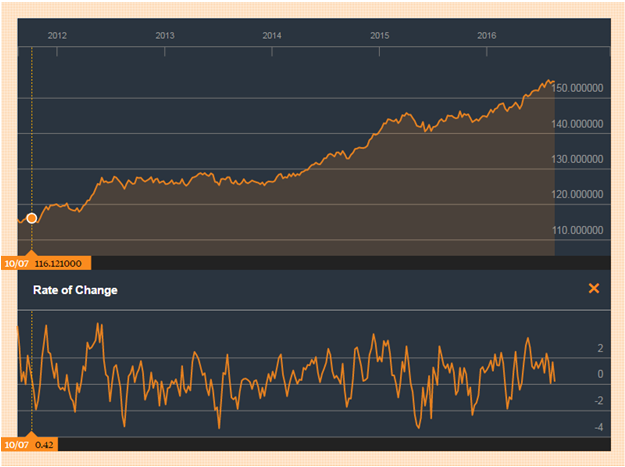

Figure 1: Australian Bond Market Metrics

(Source: BAUS Quote - Bloomberg Australia Sovereign Bond Index - Bloomberg Markets., 2016)

It can be observed from above metrics the bond market has experienced constant growth in the past 5 years as more corporate firms have relied upon bond markets in order to cope up with the credit shortage. Australian bond markets currently transact over $55 billion each day thereby forming over 90% of annual GDP of the Australian Economy. The corporate bonds have twice the amount of issuance as compared mortgage backed securities (Harford & Uysal, 2014). However, the transaction is in equal proportion in the case of public sector bonds and that of the financial sector enterprises. Due to a robust set of financial reforms undertaken by the regulatory bodies the bonds market has been bereft of speculating activities and through different investor’s awareness programs the government has tried to avoid the risk profile of the issuer company with that of the risk preference of the investors (Inchauspe, Ripple & Trück, 2015). The commonwealth government securities in particular conduct the largest issuance of sovereign debt bonds.

Financial intermediaries comprises of around 15% of bond market participants. Moreover, in terms of government bonds the Private investment banks are the largest investor as they take into account the disparities in the level of interest rates charged in case of bonds with that of corporate lending rates interests and makes profit from the rate differentials (Gozzi, Levine & Schmukler, 2012). A large number banking and financial institutions provide dealership and advisory services along with participatory activities such as issuance of 5-7 years and over 10 year bonds. The major among such institutions include Heritage Bank, Australia and New Zealand Banking Group, Westpac and Mercantile Investment Company. Participations of non residential investors are substantial in the bonds market (Alcock, Finn & Tan, 2012). Moreover, the majority of investments in Commonwealth are by non-resident individuals and investment firms.

Property investments firms follow the banking groups into issuance of corporate bonds in order to procure funding for different sets of construction and civil engineering projects. The energy companies particularly the ones engaged into oil production prefer external capital over that of capital procurements from share issues. Moreover, Inchauspe, Ripple & Trück (2015) mentions that renewable energy requires large proportion of initial funding and lower level of sustainable returns thereby increasing the level of financial leverage substantially as energy companies tends to buy its share in order to reduce long term burden of large dividend payout ratios. Companies such as Energy Australia, Ausgrid, Hydro Tasmania, and Conergy has issued numerous long term and 12 months bonds in order to facilitate expansion of their product lines and to lease in numerous power stations. Arsov (2013) states that participants in bond market usually have a lower degree of financial leverage prior to issuing bonds, moreover, large underwriting commissions in case of issuing shares dissuades many corporate firms from selecting equity financing.

Commonwealth Securities: These securities carry the largest transactions of bonds in the Australian Markets. These set of securities has the highest investment grade ratings in the among the bond market participants due to ability to repay debts through varying tax rates (Van Luu, & Yu, 2012). The numerous forms of bonds issued by the Commonwealth include Fixed Coupon Bonds, indexed bonds, treasury bills, and bonds with rate adjustability. In case of Commonwealth fixed coupon bonds the repayment occurs at the end of maturity period. The bond holders receive coupons on a biannual basis whereas the trading is conducted on yield basis (Sousa, R. M. 2015). The average maturity period of the bonds falls between periods of 11 to 13 years. In case of indexed bonds, the returns were over and above the inflation rate during the resulting in real rates of return. In case of treasury notes, the immediate capital requirements of the Australian Government are fulfilled through issuance of such notes (Elton et al.2013). Minor budget deficits and mismatch between expenditure profile and the procurement of tax revenues are addressed by the government through issuance of treasury notes.

State and Territory Government Bonds: These bonds are issued by Central Borrowing Authority (CBA) who acts on behalf of state and territorial governments in regards to collection and repayment of government backed securities. The maturity period of such bonds is similar to that of Commonwealth Government Securities (CGS) whereas the default risks are more that what are entailed in a CGS (Heath & Manning, 2012). The maturity period of state bonds vary between ranges of 1-3 years, 3-5 years, 5-7 years, 7-10 years along with over maturity period of over 10 years.

Corporate Bonds: The outstanding amounts vary widely among the corporate houses due to inherent industry dimensions and quantum of operation and expansionary costs entailed by the company (Shim, 2012). The largest number of issuer of corporate bonds comprises of nonresident entities. The construction and property investors constitute the second largest issuer of corporate bonds. The maturity periods are same as that of state government bonds. The diversification of portfolio by the investor through inclusion of non financial firm’s bonds has resulted in increasing demands for corporate bonds (Kang & Pflueger, 2015). The non financial firms capitalized upon the risk preference level of domestic investors by issuing large number of short term bonds along with bonds of over 10 year maturity period. Gyntelberg & Upper (2013) mentions in this case that the Australian corporate bond market saw exponential growth in terms of number of foreign corporate houses borrowing funds from the market, whereas, the Australian companies themselves have seen a dip in demand for their new issues. Kang & Pflueger (2015) states that corporate bonds carry a high probability of not matching the inflation rate thereby leading to an overall decrease in terms of real income of its investors. However, as foreign corporate bonds provides risk adjusted performance the overall beta of investor’s portfolio goes down thereby complimenting investors who follow tends to prefer moderate risk profile.

Individual investors: The fall in rate of returns in government bonds resulted towards shift in investment policy of individual investors. A major cause behind the influx of foreign corporate issuers in the Australian securities market can be attributed to the presence of large number of individual investors with high net worth.

Institutional investors: In terms of investment opportunities in bond markets institutional investors comprise the largest contributions to bond issues. As these investors inculcate experience in capital market scenarios, therefore investments decisions made by these set of investors tends to dictate the investment pattern followed by the individual investors. Moreover, due to the heterogeneity among institutional investors the preferences for risks levels varies as well (Becker & Ivashina, 2015). In cases of insurance companies the quantum of risk adjusted bonds in the portfolio is proportionately low as compared to that of banking institutions.

Default risk: The major concerns behind investment in corporate bonds relates to the default risks inculcated in the bond market. Even thou

Rate of interest: There remains an inverse relationship between default risks and the rate of interest. Even though the government bonds are virtually riskless they are less preferred due to low rates of interests.

Economic crisis: The European sovereign debt crisis has resulted towards large volatility in both the share and bond markets. The exposure of Australian debt market towards foreign issuers resulted in rising level of external influence upon the bond markets. Moreover, due to the fall of Brexit the repercussions in regards to divergence of capital to and from European Economies can have severe impact upon the Australian bond market in the current.

Change in government policies: The change in policies by the Federal Reserve in terms of tapering may lead to stoppage of certain trading activities in the bond market. Moreover, as the central banks around the world lower their interest rates, the returns from CGS may fall further, even lowering to the levels to below 1%.

The presence of nonresident firms in the bond market has resulted towards exposure in regards to volatility in international financial markets. Therefore regulation has to be escalated in terms of entry requirements of non residents in issuing bonds. Moreover, new list of guidelines are required to be issued in terms of credit rating process of the bonds. The purview of credit rating agencies has to be broadened in order to include the evaluation of capital structure in terms of reviewing financial ratios of the issuer firms. Through examination of the liquidity and solvency ratios, EBIT, Return on Assets are to be implemented in order to reduce the overall market risk.

Australian debt market has transformed over the years resulting in increasing transactions in the non government bond market. The diminishing rate of interests offered by the CGS over the past decade has provided corporate firms to capitalize on the high volume bond markets. The presence of different forms of tailed risks in the bond market can be mitigated through implementation of better set of regulatory laws. The growth in terms of nongovernmental bond market has resulted towards the exponential expansion of the trading activities. Though the returns are high as regards to high yield corporate bonds the default risks escalates quickly. The change in regulation policies as regards to non government bonds are to be implemented to ensure that the default risks are mitigated.

Alcock, J., Finn, F., & Tan, K. J. K. (2012). The determinants of debt maturity in Australian firms. Accounting & Finance, 52(2), 313-341.

Arsov, I., Moran, G., Shanahan, B., & Stacey, K. (2013). OTC Derivatives Reforms and the Australian Cross-currency Swap Market. RBA Bulletin, 55-64.

BAUS Quote - Bloomberg Australia Sovereign Bond Index - Bloomberg Markets. (2016). Bloomberg.com. Retrieved 20 August 2016, from http://www.bloomberg.com/quote/BAUS:IND

Becker, B., & Ivashina, V. (2015). Reaching for yield in the bond market. The Journal of Finance, 70(5), 1863-1902.

Black, S., Kirkwood, J., Williams, T., & Rai, A. (2013). A history of Australian corporate bonds. Australian Economic History Review, 53(3), 292-317.

Elton, E. J., Gruber, M. J., Blake, C. R., & Shachar, O. (2013). Why do closed-end bond funds exist? An additional explanation for the growth in domestic closed-end bond funds. Journal of Financial and Quantitative Analysis, 48(2), 405-425.

Fender, I., & Lewrick, U. (2015). Shifting tides-market liquidity and market-making in fixed income instruments. BIS Quarterly Review March.

Gozzi, J. C., Levine, R., & Schmukler, S. L. (2012). How firms use domestic and international corporate bond markets (No. w17763). National Bureau of Economic Research.

Gyntelberg, J., & Upper, C. (2013). The OTC interest rate derivatives market in 2013. BIS Quarterly Review, December.

Harford, J., & Uysal, V. B. (2014). Bond market access and investment.Journal of Financial Economics, 112(2), 147-163.

Heath, A., & Manning, M. (2012). Financial regulation and Australian dollar liquid assets. RBA Bulletin, 43-52.

Inchauspe, J., Ripple, R. D., & Trück, S. (2015). The dynamics of returns on renewable energy companies: A state-space approach. Energy Economics,48, 325-335.

Kang, J., & Pflueger, C. E. (2015). Inflation risk in corporate bonds. The Journal of Finance, 70(1), 115-162.

Shim, I. (2012). Development of Asia-Pacific corporate bond and securitisation markets. Aldamen, H., & Duncan, K. (2013). Pricing of innate and discretionary accruals in Australian debt. Accounting & Finance, 53(1), 31-53.

Smales, L. A. (2013). Impact of Macroeconomic Announcements on Interest Rate Futures: High Frequency Evidence From Australia. Journal of Financial Research, 36(3), 371-388.

Sousa, R. M. (2015). Linking wealth and labour income with stock returns and government bond yields. The European Journal of Finance, 21(10-11), 806-825.

Van Luu, B., & Yu, P. (2012). Momentum in Government-Bond Markets (Digest Summary). Journal of Fixed Income, 22(2), 72-79.

Upload your Assignment and improve Your Grade

Boost Grades