Bonanza Offer FLAT 20% off & $20 sign up bonus Order Now

injury and considerable burden of death in Australia. Hence, the ministers of federal government of this country felt the urgency of reducing alcohol consumption. They argued that by raising the tax of alcohol, the consumption of alcohol can be reduced.

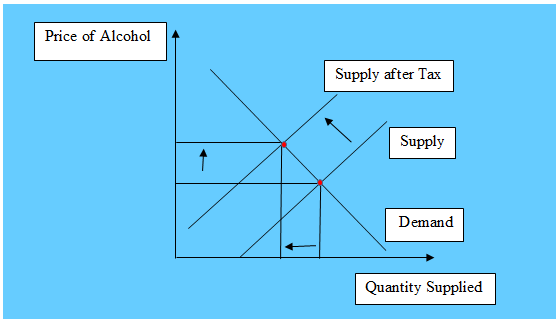

Due to increase in tax, the price of alcohol will increase. This is direct impact, if the tax is imposed on the buyers of alcohol or alcoholic beverages. This follows the simple law of demand. However, if the tax is imposed on the producers, this will indirectly curb the demand for this type of goods. In this case, producer of alcohol will reduce their production, as cost of producing alcohol has increased. Due to shortage in the supply of alcohol, the price of alcohol will rise. The increase in the price of alcohol will pull down the demand for alcohol and/or alcohol-based products (Baumol & Blinder, 2015). This can be represented with the help of following diagram.

Figure 1: Effect of Tax

Source: Created by Author

From the above diagram, it can be seen that, the supply curve shift to the left due to rise cost of producing alcohol, as tax has been imposed on alcohol production. This has caused price to rise. The price rise causes fall in demand along the demand curve (Frank, 2014). The combine effect leads to fall in quantity supplied of alcohol. Therefore, as an economist, one can suggest that tax imposition reduces consumption of alcohol.

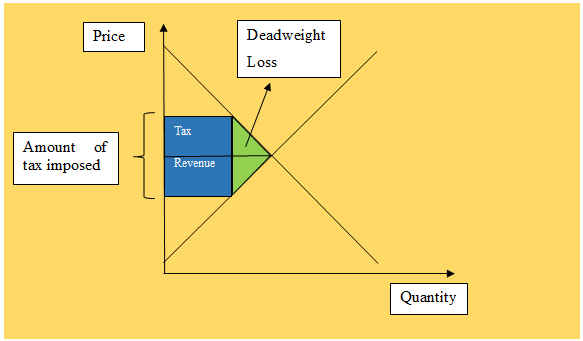

Due to rise in alcohol tax, the quantity supplied of alcohol will also reduce. However, the tax revenue will be collected by the federal government. The tax burden is getting shared between the suppliers and the buyers as well. This can be represented as follow.

Figure 2: Welfare Loss from Tax Imposition

Source: Created by Author

The above diagram reflects that; the government earns significant amount of tax revenue by imposing the tax. However, welfare is lost due to taxation and this is presented by the green triangle. The deadweight loss look place because, some buyers are not willing to pay such high price and some sellers are not willing to sell at such low price. Therefore, they do not participate in the market and a part of economic welfare is lost. However, since here Alcohol is unhealthy to consume, therefore, the more is the deadweight loss, the more the society will gain and vice versa.

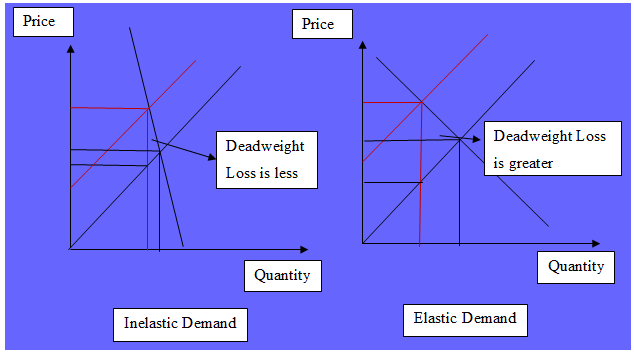

However, how much the society will gain, depends on the price elasticity of alcohol demand. If the demand for alcohol is inelastic, then rise in price of alcohol will have very little impact on the quantity bought and sold in the market. In contrast, if the demand for alcohol is elastic, then rise in price of alcohol will significantly reduce the consumption (Sørensen, 2014). The diagram below indicates the fact that, if the demand for alcohol is inelastic, then tax imposition will have little impact on the quantity demanded. For inelastic demand the Deadweight loss in alcohol market is too small, indicates that the welfare of the society is also at lower level. Moreover, there will be little impact on quantity supplied. For elastic demand, the deadweight loss is higher, indicating that the gain of the society is more (Saada, 2013). There will be significant effect on the quantity supplied.

Figure 3: Role of Elasticity on Deadweight Loss

Source: Created by Author

Since, the people are addicted to the use of alcohol, have inelastic demand for the alcohol. Therefore, tax imposition has no major impact on reducing the use of alcohol. Therefore, as an economist it can be said that tax on alcohol does not reduce its consumption as people are not price sensitive in this case. Moreover, high price of alcohol due to tax imposition induces the people to be engaged in criminal activity like money laundering; robbery etc. Therefore, the alcohol abuse is not expected to fall. Hence, minister’s claim of fall in alcohol abuse is not fully true.

Absolute advantage and comparative advantage are two fundamental concepts of international trade. According to the Adam Smith, when two countries are engaged in free trade, each country should produce and export that good that can be produced more efficiently than other. The country should import that commodity in which it is not efficient. A country is said to have absolute advantage when it produces one good at less cost than another country and the other country produces another product at less cost than the former one (Moran, 2014). These two countries exchange their goods and enjoy benefit of absolute advantage.

David Ricardo postulated comparative advantage of trade, which states that nations will produce and export that commodity in which it has lowest opportunity cost. The opportunity cost is the amount of one good given up in order to produce another good. When opportunity cost of producing one good is lower in one country than the other, then the nation is said to have comparative advantage (Krugman, Obsfeld & Meltiz, 2015).

Suppose, China and Australia can produce Car and Mobile. The following table provides the output per day when the countries are not engaged in free trade.

Table 1: Output Per Day

|

| CAR | MOBILE |

| China | 20 | 150 |

| Australia | 50 | 90 |

China can produce more Mobiles than Australia per day and Australia can produce more cars each day than China. Therefore, China is efficient in producing mobile and Australia is efficient in producing cars. Therefore, they will specialize and export in that good in which they have absolute advantage.

In some situation, it might happen that one country is efficient two commodities than the other country. However, in such cases, comparative advantage theory will be applied. The number of labours used to produce wine and cheese in US and Argentina are as follows:

Table 2: Number of Labour Requirement

|

| WINE | CHEESE |

| US | 100 | 200 |

| Argentina | 500 | 300 |

It can be seen that US has absolute advantage in producing both products. However, comparative advantage takes into account opportunity costs.

Opportunity Cost of Wine in US is 100/200= ½

Opportunity Cost of Wine in Argentina is 500/300 = 5/3

Here, ½ < 5/3

Opportunity Cost of Cheese in US is 200/100= 2

Opportunity Cost of Cheese in Argentina is 300/500 = 3/5

Here, 3/5 < 2

Therefore, US has less opportunity cost in producing Wine than Argentina, so it has comparative advantage in producing Wine. Argentina has less opportunity cost in producing Cheese than US, so it has comparative advantage in producing Cheese.US will specialize in Wine and Argentina will specialize in Cheese.

Baumol, W. J., & Blinder, A. S. (2015). Microeconomics: Principles and policy. Cengage Learning.

Frank, R. (2014). Microeconomics and behavior. McGraw-Hill Higher Education.

Sørensen, P. B. (2014). Measuring the deadweight loss from taxation in a small open economy: A general method with an application to Sweden. Journal of Public Economics, 117, 115-124.

Saada, A. S. (2013). Elasticity: theory and applications (Vol. 16). Elsevier.

Moran, T. (2014). Comparitive and Absolute Advantage.

Krugman, P. R., Obstfeld, M., & Melitz, M. (2015). International trade: theory and policy. Pearson.

Upload your Assignment and improve Your Grade

Boost Grades