Bonanza Offer FLAT 20% off & $20 sign up bonus Order Now

1.0

John Smith is preparing the income statement return for his client for the financial year which ends in 30th June. However, the client pays for advertising on 2nd July and asks to backdate the expense to the preceding financial year. By backdating the deduction (expense for advertisement), the client can reduce their amount of tax payments on an immediate basis. Though it is just a matter of two days between 30th June and 2nd July, but such expenses are incurred in another financial year which should not be backdated by the client for any personal request under the section of 25(25) of the Income Tax Act 1997. According to Fang and Whidbee (2013) the practice of backdating expense or stock option is not necessarily illegal, but there may be some ethical issues involved with respect to the client’s intension to the act. To include expenses that are to be incurred in the next financial year in advance within this financial year, the practitioner must find an intentional manipulation practices (Nichollset al. 2016). This consideration may be concluded as unethical practices of the client (Grégoire et al. 2013). This is the main ethical issue.

2.a

The given situation of the case study suggests that the client would like to backdate the deduction on order to lower the client’s income. This is an option to filing the lower tax, because the client has earned more income than expected in a particular financial year. The backdating option is not necessarily illegal, but it may be considered unethical. In order to record lower income for filing less income tax intentionally, the client approaches his tax practitioners to increase deductions. Here the client asks Finley to backdate the expense to the preceding financial year. However, the client needs to account for the expense of the options grant in their financials because an expense counts against the income (Fotak, Jiang and Lee 2016). The situation further indicates that the client intentionally would not disclose the fact behind the dating of the option.

As per the stakeholder’s analysis framework, three stakeholders are mainly involved in the scenario such as the client, the nation’s government and the tax preparing consultant, John Smith. As per the Australian accounting standards guidelines, professional ethics are reflected in the standards of conduct practiced in a profession. Therefore, unethical behavior of the tax practitioner, practiced in his profession, can affect many others in society (Fang and Whidbee 2013). Filing lower tax knowingly is a manipulative practice and the concerned parties could be affected. Therefore, the concerned stakeholders who may be harmed in the given situation are John Smith, and the government of the country. As per stakeholder’s analysis framework, the nation would collect less income from the assessee and thus the total collection of direct tax of the nation would be less.

2.b

The government of a nation is liable for collecting the income tax from the assessee (Stucke 2013). By filling reduced tax of the client, the right or claim of the nation’s government may be violated.

2.c

The client’s intention of recording expense of advertisement in the preceding financial year to file reduced taxable income is the main debatable interest of the given case study.

2.d

Being assumed that the client is an Australian assessee, the taxable income of this individual taxpayer shall be maintained the rule of Australian Taxation System. Thus it is the responsibility of the taxpayer to disclose all income and expenses which shall be accounted for within the specified financial year. To record the true and fair income picture of the assessee, the tax practitioner, on the other hand, will maintain professional ethics and a responsible behavior.

3.0

By backdating the expenses and reduce the taxable income, the following consequences will take place:

The less amount of taxable income would be disclosed and high amount of return would be collected by the individual taxpayer. Furthermore, the manipulation of transactions can be recorded by choosing the backdating option. The option of backdating may practices by assessee not only for hiding the actual figure of expenses but it also because of an intentional manipulation of individual income statement (Mudrack and Mason 2013). By following the unethical practices, the assessee may be violated the rules of Taxable system of the country. Thus this can be anticipated that there may be several occasions the government may found manipulative accounts assessments under the Income Tax Assessment Act 1997. This indicates that the government would get the less amount of direct tax at the end of the each financial year.

The same concepts have been practiced by many firms. Several firms have taken stock option backdating to reduce the corporate tax amount which often involves complex manipulation of transaction to achieve tax results. These results incur an inconsistency with the economic reality of such deal and explored many consequences to the scandal.

4.0

To be ethical, the tax professionals must comply with the legal requirements as well as the rules prescribed by the “Australian Accounting Standard Board”. By practicing under the standard of conduct, the tax practitioner should disallow the client’s request (backdating of expense) and shall be recorded it in the new financial year. To be a responsible tax payer, the client needs to account for the expense at the year in which it is incurred.

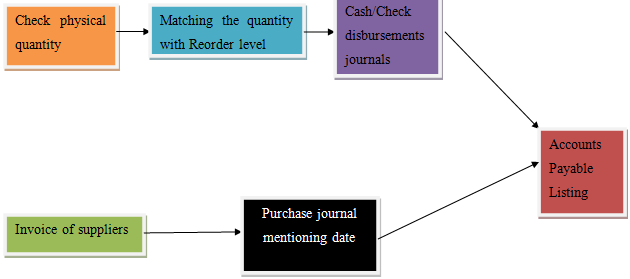

Figure 1: Flow chart for Dawn’s Engineering Expenditure Cycle

(Source: Created by author)

B.

It is good that the raw materials of Down Engineering Ltd are recorded in a storeroom and such materials can be removed from the storeroom by a written authorization of the production supervisor. However, the organization should not allow oral authorization for stock removal from the storehouse because it may increase miscommunication between the production supervisor and purchase department (Baptiste et al. 2016). Secondly, the company has recorded their inventory by the process of periodic inventory system. It means that no effort is made by the production supervisors to keep up-to-date records of either the inventory or costs of goods sold (Patil and Singh 2016).

Thus the company should follow the perpetual inventory system. Under this system, the records will be updated after the transaction is incurred. Thus it would be easier to track the transaction because perpetual inventory system records unit-count information (Solomon 2013). Furthermore, the clerk of the showroom verifies the counts which are mentioned on the bill of lading. However, such quantity may not be matched with the purchase order because such material may be lost in transit. Therefore, the company needs to record the abnormal loss of raw materials and report it to the purchase department.

C.

To avoid the manual inventory record system, the company needs to implement an integrated ERP system. This is because the ERP system automates and integrates core processes of business such as taking orders of customers, scheduling operations and keeping records of the inventory and financial data (Atiehet al. 2016). This software will help to reconcile inventory records with physical inventory. The system generated automatic recordings will be done through ERP, which helps in invoicing, warehouse receipting and authorization of purchase orders(Yi and Tu 2015). Thus, any confusion regarding the inventory recording shall then be resolved if the ERP is implemented successfully. Down’s Engineering Ltd will implement the following six steps:

Discovery and planning: Make projection based on previous sales/purchase, considering the numbers of unit sold/purchase for the month or quarter of the past year. Furthermore, priorities must be set for products that must stay in stock. This will give an idea about how the new enterprise wide system looks like and how it will work in the organisation. In this phase, current issues and documentations will be discussed.

Design: In this phase, all system configurations will be done by the project team.

Development: The entire configured system will be prepared for going live and necessary customisation will be done (Yi and Tu 2015).

Testing: After development, the system will be configured as per the project requirement.

Deployment: The implementation team will assess the situation and the final decision will be taken.

Ongoing support: Changes of system configuration will be done on a continuous basis.

A. There are several internal transactional threats an organization can identify such as general revenue cycle threats, sales order threats, shipping threats, billing threats, cash collection threats and expenditure cycle general threats and ordering as well as receiving threats. The internal control procedure is beneficial for identifying this threats which can be mitigated by different threats control activities. For instance, inaccurate inventory record is an ordering threat which can be managed by following perpetual inventory system.

By the internal control procedure five activities needs to be taken to make the control more effective. It includes:

If the wage rate of employee is to be overstated in the payroll master file, then following procedures will be taken:

C. A limit check will be done during the entry to verify the number of hours space for each employee transaction record. The limit must be specified by the management. For instance, if extra time was not permitted, they could apply eight hour for the limit. On the other hand, if extra time was permitted, they could decide instead to use nine to ten hours.

D. By using the password and accessing “control matrix” to limit personal authorization.

Test compatibility on all transactions and necessary modification will be made.

A batch salary sheet must be maintained by the departmental personnel and verify it with each payroll run as a backup control.

E. “Policy prohibited supervisors” will be implemented and verify all “unclaimed paychecks”.

F. By applying the “biometric control” the organization shall record the in and out time.

Record job time data in a detailed way and reconcile the data.

G. Controlling physical access to prevent programmers and restrict unverified access to database of the production.

Review the report of the supervisors and detect the changes or fraud incurred.

Maintain the batch total of all salaries and check them all.

H. Record the job time before processed submission.

Job time recording on the basis of clock cards.

Payroll register report maintenance and take a print out.

I. Record the loss and inform the responsible authority.

Provision for loss for the future.

J. Use “IRS Publication Circular E” and follow the instruction

Set a reminder to the cashier for doing payroll tax remittance

Atieh, A.M., Kaylani, H., Al-abdallat, Y., Qaderi, A., Ghoul, L., Jaradat, L. and Hdairis, I., 2016. Performance improvement of inventory management system processes by an automated warehouse management system.Procedia CIRP, 41, pp.568-572.

Baptiste, R., Geraty, T., Brinkerhoff, M. and Barnett, W., Mathew Baptiste, 2016. Inventory control system. U.S. Patent 9,341,001.

Fang, H. and Whidbee, D., 2013. The economic rationale for option backdating: incentive explanations. Managerial Finance, 39(11), pp.1004-1031.

Fotak, V., Jiang, F. and Lee, H., 2016. Unethical Behavior and Debt Contracting: Evidence from Backdated Option Grants. Available at SSRN 2802892.

Grégoire, P., Glenn Hubbard, R., Koehn, M.F., Audenrode, M.V. and Royer, J., 2013. Is backdating executive stock options always costly to shareholders?. Accounting & Finance, 53(3), pp.667-689.

Mudrack, P.E. and Mason, E.S., 2013. Ethical judgments: What do we know, where do we go?. Journal of Business Ethics, 115(3), pp.575-597.

Nicholls, C.C., Sandler, D., Tedds, L.M. and Compton, R.A., 2016. Quantifying the Personal Income Tax Benefits of Backdating: A Canada–US Comparison. Columbia Journal of Tax Law, 3(2).

Patil, R. and Singh, G., 2016, August. Inventory management and analysis in an orthodontic practice. In Seminars in Orthodontics. WB Saunders.

Solomon, S.B., Worthwhile Products, 2013. Inventory control system. U.S. Patent 8,374,926.

Stucke, M.E., 2013. In search of effective ethics & compliance programs. J. Corp. L., 39, p.769.

Varrasso, S., 2014. Inventory control system. U.S. Patent Application 14/497,283.

Yi, L. and Tu, J., 2015. Method Research to Improve Inventory Management based on Enterprise Resource Planning (ERP) Environment.

Upload your Assignment and improve Your Grade

Boost Grades