Bonanza Offer FLAT 20% off & $20 sign up bonus Order Now

Discuss about the Income Tax Law.

Backpackers who come to visit Australia to work during holidays will be charged by 15% tax inspite of warning given by the farmers of Australia as it will cause adversity because, the newly applicable tax will dishearten travellers from engaging in jobs like seasonal fruit-picker. Initially, the prime minister, Malcom Turnbull proposed the said tax at a higher rate of 32.5%. However, due to failure of securing support from the crossbench and lowered the rate to 19%. The newly applied tax rate will affect approximately 200,000 backpackers, aged between 18 years and 30 years who come from different corner of the world in working visas of 12 months.

With the handing down of budget for the year 2016-17, and the federal campaign for election in full fledge, that was the best time to evaluate the tax impact on Australian politics. The goal behind imposing the Backpacker tax was to collect the money from the the travellers who come to Australia for doing job during holidays. At the same time the policy maker did not wanted that the new tax policy should cause a burden for the working holiday makers or should not stop them from coming to the country (Brickenstein 2015). Their objective was to increase the taxes for Departing Australia Superannuation Payment (DASP), from 35 percent to 60 percent and even to 100 percent, if possible. This will also have a significant impact on Australia’s future employment market. Temporary workers who works availing visa habitually end up in unstable long-lasting working situation. After granting the permanent status only they reported about the insecure working conditions (Dabner 2016).

The reduced tax rate from 32.5% to 19% will go long way in attracting the seasonal workforce that is required to balance with the high level of demand for labours. Working holidaymakers play an important role in tourism and agricultural sector of Australia. 19% tax rate will assist in maintaining Australia’s position as a competitive target for working holiday makers and at the same time ensuring that they will contribute at their fair tax level (Dwyer et al. 2014).

Despite of reducing the rate of backpacker tax from 32.5% to 19%, it has various disadvantages on the holiday workers. Superannuation of these workers will be taxed at 95% now at the time of leaving Australia. Though the cost of visa for working holiday will drop by $50, it will still be higher as compared to other countries (Li and Whitworth 2016). Visa for working holiday was initially set up as a symbol for cultural exchange and it used to allow young visitors from all over the world to work for a period of six months or 1 year, if they prefer to work in rural and regional part of Australia. However, higher cost of visa will cause as a burden to the working holidaymaker group and will refrained them from coming to Australia for work purpose (Li 2015).

The backpacker tax will have greatest impact on the farmers of Australia and the tax office of Australia could not provide considerable information regarding the forthcoming situation and simply directed the people to visit their website. Another argument was between the Australian government and the political parties, which caused the delay of six month for payment of tax (McCluskey 2016). Other key issues were as follows:

Individuals who will be faced great consequence of the proposed change will be the contributors of “working holiday maker program”. This program permits the young age group between 18 years and 30 years from the partner nations for working in Australia during the holiday period. The only purpose of their visit must not be work but also the exchange program of culture as well that will enable the young workers to avail a comprehensive holiday and make money through short-term job.

At present, if someone wishes to work as holiday worker, he has to collect tax file number from Australia. These numbers are only available for non-residents forming the working visas in required form. Types of working visas are:

However, with the new tax implications it is not visible that whether the proposed tax will enlarge to all kinds of visa holder.

Consequence of tax after the proposed change:

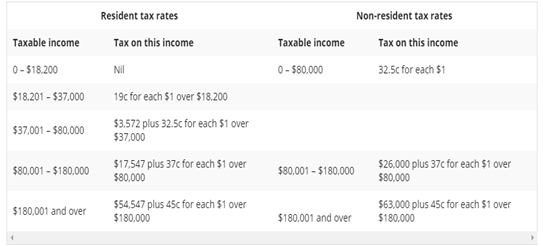

The new tax proposal will alter the rate of personal income tax applied to the non-residents. The difference in rate of personal income tax for non-residents and residents can be shown through the following table:

Table 1: Resident and non-resident tax rates

(Source: ATO)

Impact on superannuation payments:

Proposed change in the tax rate will not only have impact on working holiday makers as higher rate of tax as compared to the residents, but also it will have the impact on temporary residents who are departing from Australia on permanent basis and want to withdraw the accumulated balance from superannuation (Australian Public Service Commission 2013). The rate of tax on their superannuation ranges between 38% to 47% whereas the tax rate for the residents taking out balance from superannuation before reaching the prevention age is 20%.

Some other expected problems due to the proposed changes are as follows:

From the above discussions, it is concluded that does not meet the characteristics of a good tax system as it will have a bad impact on working holiday makers as well as the farmers of Australia. Characteristics of forming a good tax system are to plan with consideration with all the taxpayers. As it has so many limitations, it does not meet the criteria of a good tax system.

The decision of removing the backpacker’s entry to for tax-free doorstep was declared by the Liberal-National government in the budget of May, 2015 as a measure of revenue. At present the backpackers are able to have access $18,200 tax-free limit, lower rate of tax at 19% and offset of low-income tax for the limit up to $37,000. Due to the proposed change, the makers of working holiday will be charged at a high rate of 32.5% and be taxed as non-residents which in turn will enable the Australian government to earn more revenue from tax (Sharkey 2015). Australian government made the statement to the public that the proposed change will give the best possible outcome for their country as well as their community. The other reasons behind the proposed changes are as follows:

Jai, a Malaysian citizen having appropriate visa for working in Australia and tax file number worked for 12 months in Australia as fruit picker under the working holiday maker and earned $17, 500 on that. However, while living Australia, he did not pay any tax on that amount as he considered himself as resident for staying 12 months in the country.

However, he wants to come in Australia for another 12 months in 2017 under working holiday. If he earns $17,500 now, then the applicable tax on that amount as per the proposed tax rates for the period of 2017 will be as follows:

Reference:

Australian Public Service Commission, 2013. Capability review: Australian Taxation Office. Canberra: Commonwealth of Australia.

Brickenstein, C., 2015. Impact assessment of seasonal labor migration in Australia and New Zealand: A win–win situation?. Asian and Pacific Migration Journal, 24(1), pp.107-129.

Dabner, J.H., 2016. Federal Budget 2016-17 Tax Changes (Aka Tax White Paper). Available at SSRN.

Dwyer, L., Pham, T., Forsyth, P. and Spurr, R., 2014. Destination Marketing of Australia Return on Investment. Journal of Travel Research, 53(3), pp.281-295.

Li, Y.T. and Whitworth, K., 2016. When the State Becomes Part of the Exploitation: Migrants’ Agency within the Institutional Constraints in Australia. International Migration.

Li, Y.T., 2015. Constituting co-ethnic exploitation: The economic and cultural meanings of cash-in-hand jobs for ethnic Chinese migrants in Australia. Critical Sociology, p.0896920515606504.

McCluskey, S., 2016. Tax in Agriculture.

Rice, P., 2014. Universal management: a proposal to change the direction of accessibility management in the Australian tourism industry to create benefits for all Australians and visitors to Australia. Review of Disability Studies: An International Journal, 2(2).

Richardson, G., Taylor, G. and Lanis, R., 2013. Determinants of transfer pricing aggressiveness: Empirical evidence from Australian firms. Journal of Contemporary Accounting & Economics, 9(2), pp.136-150.

Sharkey, N., 2015. Coming to Australia: Cross border and Australian income tax complexities with a focus on dual residence and DTAs and those from China, Singapore and Hong Kong-Part 1. Brief, 42(10), p.10.

Toth, S. and Burns, A., 2016. Mid market focus: Company tax rates: Consider the total tax liability. Taxation in Australia, 51(5), p.245.

Wong, V., 2014. Building wealth: EOFY strategies to maximum benefit. Medicus, 54(3), p.46.

Upload your Assignment and improve Your Grade

Boost Grades